Health Insurance Basics

Health Insurance Terminology

Copay

The fee you pay for covered services, usually due at the time you receive care. For example, you might pay a $15 copay to see a primary care doctor or specialist.

Co-Insurance

The financial part of a medical service you’re responsible for. For example, you might pay 20% of the cost for a particular service, and the health insurance plan will pay the remaining 80%.

Annual deductible

The amount you have to pay toward medical costs before your health insurance plan starts paying part of the bill.

Emergency

An illness, injury, symptom or condition so serious that a reasonable person would seek care right away to avoid severe harm or death.

Out of pocket maximum

The maximum amount of money you’ll have to pay for health care in a year. After you meet the maximum, your health insurance plan covers 100% of all eligible costs for the rest of the plan year.

In-Network

A group of healthcare providers and facilities—including doctors, hospitals, and labs—that contract with your healthcare plan to provide services at negotiated discount rates. You’ll usually pay less when you use a network healthcare provider. WPI SHIP contracts with Blue Cross Blue Shield to provide access to its extensive network of hospitals and providers. In-network options for students enrolled in the WPI student health insurance plan can be found HERE (choose PPO or EPO from the Network drop-down).

Out-of-Network

Health care professionals, hospitals, clinics, and labs that do not belong to the Blue Cross Blue Shield PPO network. You’ll typically pay more and may need to file a claim for payment.

Referral

Written authorization given by the student health center (SHC) to seek care outside of the SHC for medically necessary services.

Maximum Allowed Amount

The total reimbursement payable under your plan for covered services you receive in-network and out-of-network providers. It is the claims administrator’s payment toward the services billed by your provider, combined with any deductible or coinsurance you may owe. If you receive services from an out-of-network provider, the provider will bill you the different, if any, between their charges and the maximum allowed amount.

Health insurance tips

How does the US healthcare system work?

The following video is a great resource and teaches students how the U.S. healthcare system works, and how students should seek appropriate medical care if they become sick or injured.

HealthCare in the US can be very complex and confusing. We encourage students who have questions about their coverage or any billing to contact our representative at University Health Plans via email at info@univhealthplans.com.

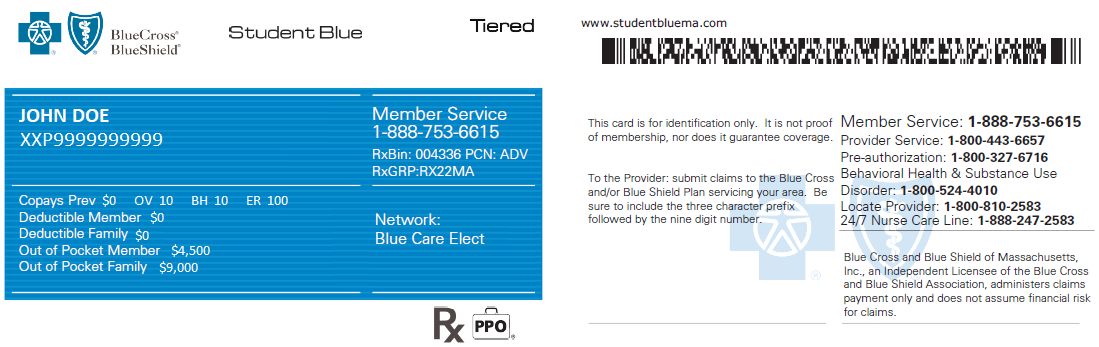

Your insurance card

Always keep your health insurance card with you. You will need to present this card whenever you seek medical attention in the United States. If you have the WPI Student Health Insurance you can obtain a copy of your card through the BCBSMA MyBlue Member App or by creating a MyBlue account. Learn more about the MyBlue Member App HERE.

Finding medical and mental health providers

To best utilize your student health insurance, you will need to search for local providers (medical providers and mental health providers) in the Blue Cross Blue Shield PPO network to ensure that your insurance is accepted at their practice. It is also helpful to utilize the BCBSMA MyBlue Member App or MyBlue account to find providers, access your benefit information, ID cards, claims, and other plan details.

After your appointment

Following your appointment, you may receive an Explanation of Benefits (EOB). Always review your EOB for errors or uncovered expenses. An EOB is a description of payments issues by the insurance company after a claim has been processed. The EOB will also state the remaining amount that may be owed by the policyholder (you, the student) to the medical provider. Note: this is not a bill, but an explanation of covered expenses. You will likely receive a bill directly from your medical provider that you must pay.

About your medical benefits

Holders of the WPI Health Insurance plan can find their medical benefits outline here. Specific questions about the plan benefits should be directed to info@univhealthplans.com.

Local physical and mental healthcare options

WPI Student Health Services

WPI Student Health Services provides medical care to WPI students; more information can be found here.

Mental Health Resources

The Student Development & Counseling Center (SDCC) provides free and confidential counseling, guidance, and support––or just someone to talk to––24/7. Please visit the SDCC page for more mental health resources on the WPI campus and within the greater Worcester Community.

BCBSMA’s Well Connection virtual counseling is available to students that are enrolled in the WPI student health insurance plan. Please use the BCBSMA MyBlue Member App or MyBlue account to request a virtual counseling appointment that fits your schedule. In addition to Well Connection, BCBSMA offers a Mental Health Resource Center where students can find in-network mental health providers currently accepting new patients, access virtual care, and more.

Urgent Care

Urgent care offices provide a wide range of medical care with extended hours and on weekends. These offices can provide a higher level of care than WPI Student Health Services, but not as high a level of care as a hospital emergency department. Students can be seen at the local urgent care locations on a walk-in basis. Urgent care offices can provide x-ray and electrocardiogram (EKG) services as well.

Please explore the different urgent care locations below to see what they have to offer their patients.

- CVS Minute Clinic located at 44 West Boylston Street in Worcester

- ReadyMed Urgent Care at 366 Shrewsbury Street in Worcester

- AFC Urgent Care at 117 Stafford Street in Worcester

Urgent care offices may bill you or charge a copayment based on your health insurance plan. Please call your health insurance plan directly to determine the cost.

Virtual general medical visits are available to students that are enrolled in the WPI student health insurance plan. Please use BCBSMA’s Well Connection via the BCBSMA MyBlue Member App or MyBlue account to request a virtual medical or counseling appointments that fits your schedule.

Emergency Department

Emergency departments and hospitals provide 24/7 care for emergent illnesses and injuries that cannot wait to be treated. You do not need an appointment to be seen at an emergency department, you can walk in at any time, but may have to wait.

If you are experiencing a medical emergency on campus and need an ambulance, please call campus police at 508-831-5555 or if you are off campus call 911.

The closest hospitals and emergency rooms to the WPI campus are:

- UMass Memorial Medical Center- Memorial Campus at 119 Belmont Street Worcester

- UMass Memorial Medical Center- University Campus at 55 Lake Avenue North Worcester

- Saint Vincent’s Hospital at 123 Summer Street Worcester.

Emergency departments may bill you or charge a copayment based on your health insurance plan. Please call your health insurance plan directly to determine the cost. Visits to the emergency department can be expensive but required for life threatening illnesses and injuries.

Pharmacy

Several pharmacies are located within a short distance from campus and are available for all your medication needs, including over the counter and prescription medications.

The closest pharmacies to campus are:

- CVS at 44 West Boylston Street in Worcester (1.2 mile walk from the WPI Quad)

- CVS at 400 Park Avenue in Worcester (1.4 mile walk from the WPI Quad)

- Walgreens at 320 Park Avenue in Worcester (1.2 mile walk from the WPI Quad)

How to use your health insurance

I just enrolled with WPI’s student health insurance plan. What do I do next?

- Download a copy of your insurance card to your phone, and keep another physical copy with you at all times.

- Your insurance card can be found via the BCBSMA MyBlue Member App or MyBlue account

- If you have any chronic health problems (including behavioral health diagnoses) and are hoping to seek care for these medical conditions while studying in the U.S., consider getting set up with a primary care medical provider.

- To find in-network providers, please follow this link

- Alternatively, you can log into your MyBlue Member App or MyBlue account and click “Find a provider.”

-

Familiarize yourself with your insurance card (please note, there may be slight differences in the insurance card’s appearance from academic year to academic year).

Student Health Insurance Plan sample insurance card.

I’m looking for more specific information regarding my insurance. Where should I look?

For detailed information about the 2025-2026 WPI Student Heath Insurance plan, please visit, www.universityhealthplans.com/WPI

I’m sick/hurt and I want to be evaluated. What’s the difference between the hospital emergency room and an urgent care clinic?

Urgent care clinics are generally walk-in clinics that are equipped to deal with urgent, but non-life threatening medical conditions. Meanwhile, emergency rooms or emergency departments are walk-in, hospital-based locations that are equipped to deal with major and/or life-threatening medical conditions.

I have these symptoms. Where do I go next?

| Urgent Care | Emergency room/department ** |

| Cold and flu-like symptoms (e.g. cough, congestion, sore throat, low grade fever, body aches, fatigue, mild headache) | Chest pain or feeling that the heart is beating irregularly or too fast |

| Ligament sprains and muscle strains | Shortness of breath or difficulty breathing |

| Mild abdominal pain | Severe abdominal pain |

| Urinary tract infection symptoms | Allergic reactions causing facial swelling, throat tightness, difficulty swallowing, shortness of breath or difficulty breathing |

| Minor wounds such as burns and small lacerations, abrasions, or cuts | Severe injuries (e.g. broken bones or dislocated joints, large or deep lacerations, persistent bleeding) |

| Vomiting and/or diarrhea | High, sustained fevers (>103F or >39.4C) |

| Skin infections | Severe head injuries with or without loss of consciousness |

| Sexually transmitted infection (STI) screening | Severe headaches or seizures |

| Ear pain or changes in hearing | Mental health crises, or intent of harming self or others |

| Concern for conjunctivitis (also commonly known as “pink eye”) | Weakness or numbness to one side of body or to one limb |

| Genitourinary symptoms (e.g. vaginal or penile itch, pain, discharge) | Sexual assault, physical assault, or injuries from car accidents |

**Emergency room visits and being transported via an ambulance are oftentimes much more expensive than an urgent care visit. Please note, an urgent care clinic may still recommend you go to an emergency room/department if they deem your medical presentation requires a higher level of care than they can provide.

Where is the nearest urgent care clinic or emergency room?

- Urgent care clinics

- ReadyMed Plus on 366 Shrewsbury St, Worcester, MA 01604

- CareWell Urgent Care on 500 Lincoln St, Worcester, MA 01605

- AFC Urgent Care on 117 Stafford St, Worcester, MA 01603

- CVS Minute Clinic on 44 W. Boylston St, Worcester, MA 01605

- Limited services – please check above link to view available services

- Emergency rooms/departments

- UMass Memorial (Memorial campus) on 119 Belmont St, Worcester, MA 01605

- Saint Vincent Hospital on 123 Summer St, Worcester, MA 01608

- UMass Memorial (University campus) on 55 Lake Avenue North, Worcester, MA 01655

I am going to make a medical appointment but how will I give them my insurance information and what is the payment process like?

- When you schedule your appointment over the phone, the medical office staff will collect your insurance information ahead of time.

- If you do not provide your insurance information at the time of scheduling the appointment, you will likely need to provide that information when you arrive to check in for your appointment – so make sure to bring a copy of your insurance card with you.

- You will need to pay any copays if applicable.

- You will see your medical provider.

- Once your visit is over, your medical provider will bill the health insurance company for services that the provider rendered (performed) during the visit.

- Your insurance company will process this claim from this medical provider and will pay its share accordingly. You may need to then pay the remaining cost to the medical office depending on your insurance plan’s coinsurance amount.

Still have questions?

Feel free to call or email WPI Student Health Services (SHS) and we will do our best to answer those questions and help guide you in the right direction!

WPI Student Health Services

Daniels Hall, 84 Institute Rd, Worcester, MA 01609

Tel: 508-831-5520 | Fax: 508-831-5953 | Email: SHS@wpi.edu