Department(s):

Division of Talent & Inclusion2024 Harvard Pilgrim Health Insurance Rates

The 2024 Open Enrollment election period is now open. Employees are now able to log into Workday to complete their benefit elections for 2024. IMPORTANT: Enrollment is Active this year for Health Insurance, HSA, and FSAs! What does this mean for you? You must actively select and enroll in your medical coverage and your Health Spending Account or Flexible Spending Account(s) to have coverage for 2024. If you do not, your current coverage for those benefits will not roll over.

All changes will take effect January 1, 2024. We encourage you to take the time to review the 2024 Benefits Guide to educate yourself about your options and choose the best coverage for you and your family. Don’t forget to utilize the Decision Doc tool - HYKE (formerly My Health Math) or the seek resources from the Benefits Website to assist with your selections. Be sure to visit us at the Benefits Fair on Thursday, November 2nd from 11am – 2pm at the Rubin Campus Center, Odeum A & B

Follow these 10 easy steps to make and submit your 2023 benefit elections in Workday.

- Log in to Workday

- Find the Open Enrollment task in your Inbox

- Click ‘Let’s Get Started’

- Add, Change and/or Review your desired elections for 2024 (Health Insurance, HSA and FSA participants must reelect/enroll benefits this year. HDHP members must enroll and elect $0.00 to receive the WPI employer HSA contribution)

- Click Review and Sign

- Review all elected benefits, waived benefits and messages to ensure you have everything you need for 2024.

- Under the Electronic Signature subheading check the box – ‘I Accept’ after reading through the legal notices.

- Submit

- Done

- Breathe a sigh of relief – you have completed Open Enrollment 2024!

Drop-In Q & A and Enrollment Sessions

During the Open Enrollment period, the Benefits Team will be available for employees to drop-in for support and assistance with entering 2024 elections in Workday and to get benefit plan questions answered. Below is a listing of sessions offered to employees over the course of the Open Enrollment election period. As a reminder, employees who participate in WPI health insurance, HSA and FSA plans MUST make an enrollment election in Workday before the end of the day on November 15th.

- Tuesday, October 31st – Salisbury Labs 123 – 2pm-3:30pm

- Thursday, November 9th – Salisbury Labs 123 – 3:30pm – 5pm

- Monday, November 13th – Higgins Lab 230 – 11:30am – 1:30pm

- Tuesday, November 14th – Salisbury Labs 123 – 2:30pm – 4:30pm

Open Enrollment 2024

WPI employees now have the opportunity to add or remove as well as make changes and updates to their current benefit elections from October 31st – November 15th in Workday. All changes will take effect January 1, 2024. We encourage you to take the time to review the 2024 Benefits Guide to educate yourself about your options and choose the best coverage for you and your family. IMPORTANT: Open Enrollment is Active This Year for Medical Coverage, HSA, and FSAs! What does this mean for you? You must actively select and enroll in your medical coverage and your Health Spending Account or Flexible Spending Account(s) in order to have coverage for 2024. If you do not, your current coverage for those benefits will not roll over.

Enhancements & Changes for 2024 Benefits Plan Year

Here’s a quick summary of what’s new for 2024 (these are covered in greater detail below):

- Tufts has merged with Harvard Pilgrim Health Care. You will continue to have the same plans with the same coverage as you do today, just administered under the Harvard Pilgrim Health Care name.

- We are increasing the number of coverage levels from two (Individual and Family) to three (Individual, Employee + Child(ren), and Family). When you cover yourself and your spouse or domestic partner, you will be enrolled in Family coverage. The coverage level is defined by who you cover in a plan and drives what you will pay in per-paycheck deductions.

- Delta Dental will administer our dental plans beginning January 1.

- Voya will administer our Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) beginning January 1.

- The HSA limits have increased for 2024.

- The FSA 2024 limits have not yet been announced.

- The Hartford began administering our Life and Accidental Death & Dismemberment Insurance effective October 1, 2023.

- MyHealthMath, a Decision Doc tool, is now called HYKE.

UPDATE: Tufts is now Harvard Pilgrim Health Care – Important information for WPI health insurance participants: You MUST re-enroll in health insurance this year !

Harvard Pilgrim Health Care (HPHC) will continue to offer the same plans with the same coverage as you have today. HPHC and Tufts are partnering to ensure that most providers remain in-network. While most members won’t experience disruption, you can take the following steps if needed to ensure your providers are in-network:

→ If you find you need to choose a new in-network provider, you can search the HPHC website at www.harvardpilgrim.org/public/home.

→ See the WPI Benefits Website for more information.

Things to know as we transition to Harvard Pilgrim Health Care:

- The PPO National Network is transitioning from Cigna to United Healthcare.

- You’ll receive new medical plan ID cards before January 1, 2024.

- All open pre-certifications, pre-authorizations, and referrals will automatically carry over to HPHC. There is no need to request anything new from your provider.

- Tufts Health Plan members who require uninterrupted care from an out-of-network provider will be protected for a 90-day period. All services during the Continuity of Care period will be considered in-network. On going claim analysis will be conducted to ensure members pay in-network cost share. Once the 90 day period ends, members will be notified of their options to choose new providers or acquire services as out of network with the appropriate cost share based on their plan design.

- Have questions or just want to put your mind at ease? MyConnect is a member advocate service team available to members, whether they have questions about benefits, need help finding care, or are trying to meet healthy lifestyle goals.

NEW: Employee + Child(ren) coverage tier for medical plans: For 2024, we are moving from two coverage levels (Individual and Family) to three coverage levels (Individual, Employee +Child(ren), and Family) for your medical plans. This tier allows employees the ability to cover children up to age 26. (When you cover yourself and your spouse or domestic partner, you will be enrolled in Family coverage.)

Why is this change only for Employee +Child(ren)? Claims experience and historical data continue to substantiate that older consumers of healthcare require higher volumes of services and prescription drug coverage as compared to younger consumers. Based on the data, this tier was created to provide a more affordable tier for employees covering a child or multiple children who in comparison do not incur high volume claims.

UPDATE: Delta Dental will administer our dental coverage beginning January 1. You will have access to same coverage as you have today with world-class service from Delta Dental. Additionally, through the Right Start 4 Kids Program, Delta Dental offers free dental care for covered children under the age of 13 (this does not include orthodontic services). Be on the lookout for new ID cards coming before January 1, 2024. If you are currently enrolled with Altus Dental, plans will automatically map in Workday to Delta Dental during Open Enrollment. For example, if you currently elect the Altus Low Plan you will automatically be enrolled in the Delta Dental Low Plan.

UPDATE: Voya will administer our Health Savings Account and Flexible Spending Accounts beginning January 1. We are moving from Fidelity Investments to Voya (formerly Benefits Strategies) for your HSA and/or FSAs. Participants will receive new debit cards as needed before the start of the plan year. If you are an existing HSA participant with Fidelity, you will receive information and a request for authorization to transfer HSA funds to VOYA soon. If you are a current FSA participant with Fidelity, your 2023 account will remain with Fidelity and you will follow the normal run-out period and reimbursement process.

IMPORTANT REMINDER: HSA and FSA participants – Employees must re-elect these benefits in 2024

Under IRS regulations, participants in the Health Savings Account (HSA) and Flexible Spending Account (FSA) benefit must re-enroll each plan year. These are pre-tax accounts that provide employees with taxable savings to offset the cost of medical and/or dependent care expenses. Elections must be made in Workday between October 31st and November 15th for 2024. Employees participating in an HSA and/or FSA benefit in 2023 who wish to have an election in 2024 must re-enroll during Open Enrollment. If you wish to enroll in an HSA, you can now contribute up to $4,150 for individual medical coverage and $8,300 for Employee + Child(ren) or Family coverage in 2024. Employees 55 and older can contribute an additional $1,000 as a catch-up contribution. If you are enrolled in a Health Care FSA, you can contribute up to $3,050 for both the Health Care and Limited Purpose Care FSA.

UPDATE: The Hartford will administer our Life and Accidental Death & Dismemberment Insurance and Short-Term Disability (STD) and Long-Term Disability (LTD) beginning October 1, 2023. You will have access to the same WPI paid Basic Life coverage and employee paid Voluntary Life options. Your current coverage carried over from Prudential to The Hartford effective 10/1/2023. Due to the change in insurance company, The Hartford is allowing employees to participate in a one-time Life Insurance Guarantee Issue enrollment during this Open Enrollment period. What does this mean? All benefit eligible employees can request up to the Guarantee Issue amounts - $200,000 of life insurance coverage for employee and up to $30,000 for spouse/domestic partner - without the requirement of providing Evidence of Insurability (EOI). Selections over the Guarantee Issue amount will be subject to the EOI process through Hartford.

UPDATE: MyHealthMath - Decision Doc is now HYKE – This tool is free for benefit eligible employees looking to cost compare health, dental and vision insurance plans. The HYKE platform assists employees with selecting the benefit plan most suited to their specific needs while providing a recommendation for best overall financial value. Employees will navigate the tool via a designated web link, answer questions based on individual and covered family member needs and in turn will be provided with a recommendation for health, dental and/or vision plans and more for the 2024 plan year. Employees are not obligated to select the recommended plan(s). This tool will be available beginning October 25th for employees.

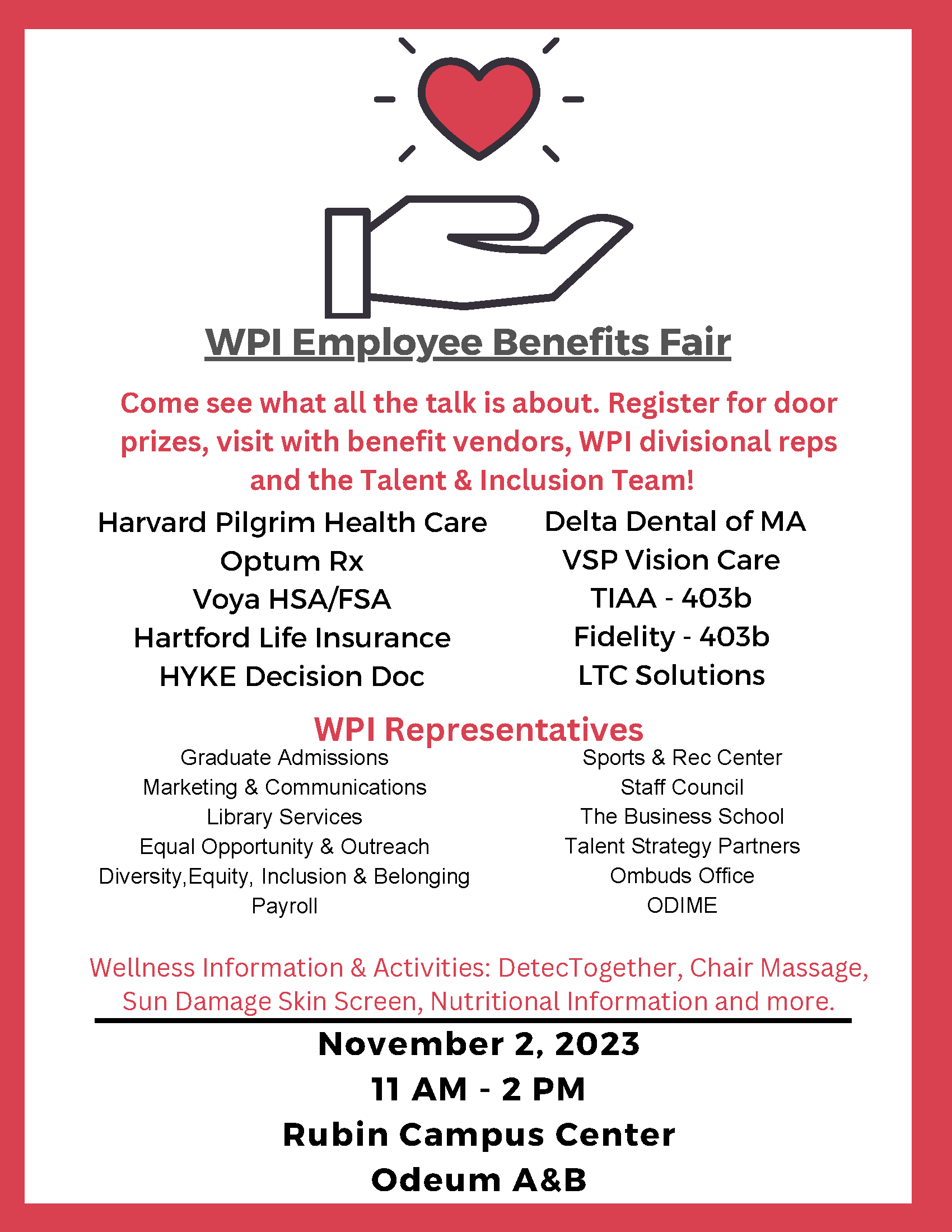

WPI Employee Benefits Fair & Wellness Activities

Save the Date: The Benefits Team will host an onsite Employee Benefits Fair on Thursday, November 2nd from 11am – 2pm at the Rubin Campus Center, Odeum A & B. Vendors will be available to answer questions and provide information related to the plans offered to WPI benefit eligible employees. There will be door prizes, chair massage, onsite vision exams and other health activity offerings. Be sure to swing by to visit with vendors, WPI representatives from the divisions below as well as the WPI Talent and Inclusion Benefits Team.

Onsite Eye Exam Appointments: Schedule an eye exam appointment through 20/20 Onsite November 2nd from 8am – 3pm. What could be more convenient than a short walk across campus to get your annual eye examination checked off your wellness to-do list? Schedule an appointment here. All employees who schedule and complete their eye exam onsite will be entered into a raffle for a chance to win a Versa 4 Fitbit Smartwatch.

Chair Massage: Back by popular demand. Chair massage appointments will be available to employees throughout the duration of the Benefits Fair. Employees must schedule an appointment to receive a chair massage. To book an appointment click here.

|

WPI Benefit Vendors |

|

WPI Divisions |

||

|

Harvard Pilgrim Health Care |

Delta Dental |

|

Graduate Admissions |

Office of Equal Opportunity & Outreach |

|

VSP Vision |

Optum Rx |

|

School of Business |

Marketing & Communications |

|

The Hartford Insurance |

Voya FSA and HSA |

|

Talent & Inclusion - Talent Strategy Partners |

WPI Sports & Recreation Center |

|

Fidelity Retirement |

TIAA Retirement with SAVI – Student Debt Solution |

|

Library Services |

Staff Council |

|

MetLife Legal Plans |

HYKE (formerly MyHealthMath) |

|

Payroll |

ODIME - Collegiate Religious Center (CRC) |

|

LTC Long Term Care Solutions |

DetecTogether |

|||

Additional Resources

- Refer to the Open Enrollment Newsletter that you recently received in the mail.

- Review your 2024 Benefits Guide to explore your benefits.