FinTech Lab at WPI

WPI FLAME University FinTech Lab: PIONEERING FINANCIAL INNOVATION

Established in 2023, the FLAME-WPI FinTech Laboratory represents a confluence of finance and technology. This union, commonly referred to as FinTech, is transforming the landscape of financial services by making access more democratic and reshaping conventional practices.

The Lab acknowledges the crucial role that skilled individuals play in spearheading this transformation. In response, it has tailored its operations to bolster Worcester Polytechnic Institute's (WPI) support for exemplary undergraduate and graduate research, faculty exchanges, course development, entrepreneurship, conferences, and other professional growth activities. It encourages interdisciplinary collaboration, thereby creating a vibrant ecosystem where finance, technology, data science, and entrepreneurship experts come together to forge innovative solutions.

At its heart, the Laboratory functions as a hub for research, experimentation, and education. It provides students and professionals alike with the necessary knowledge and skills to understand the intricacies of FinTech, enabling them to become innovators and agents of change.

With a strong emphasis on continuous learning and cooperation, the FinTech Lab is well-positioned to influence the future of finance. As FinTech persistently reshapes the financial environment, the Laboratory is instrumental in driving the ongoing evolution of the global economy.

.

Vision of the FinTech Lab: Driving Innovation and Collaboration in Financial Technology

The WPI/FLAME University FinTech Lab is a dynamic hub at the intersection of technology and finance. It drives innovation through:

- Creation of New Knowledge: Conducting cutting-edge research to generate fresh insights in FinTech.

- Manage and Disseminate Knowledge: Effectively managing and disseminating new and existing knowledge to enrich the FinTech community.

- Act as a Hub for Student Projects: Providing a platform for hands-on student projects in financial technology.

- Foster an Ecosystem for Start-ups: Fostering an entrepreneurial ecosystem for FinTech start-ups through mentorship and resources.

- Contribute to the FinTech Ecosystem: Actively contributing to the FinTech ecosystem in FLAME and WPI regions, promoting collaboration, innovation, and economic development. Through these initiatives, the Lab accelerates progress and drives positive change in the FinTech landscape.

.

WPI FinTech Lab Accomplishments: Research and Presentations

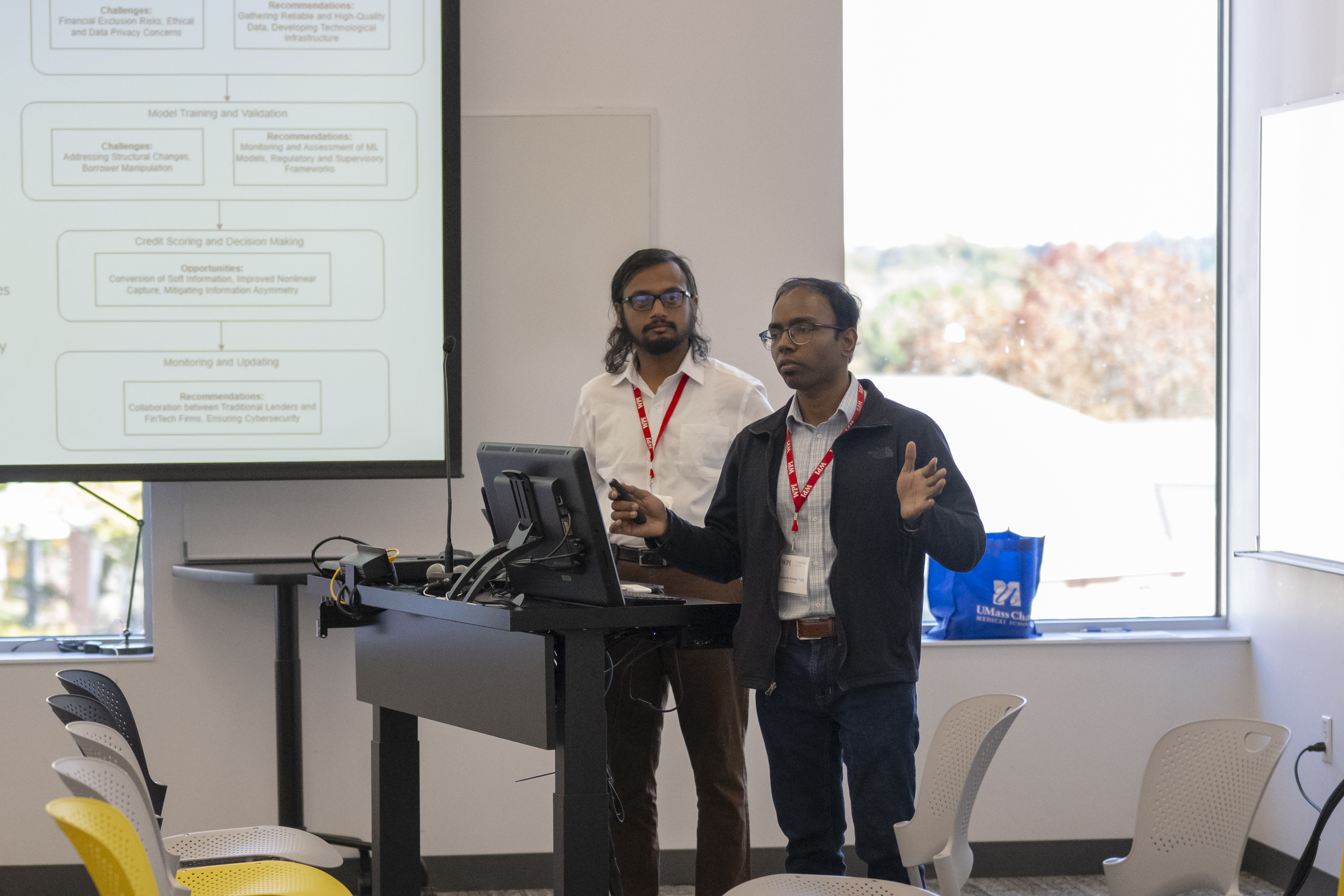

As an integral component of its commitment to advancing FinTech education and training, the FLAME-WPI FinTech Lab hosted its first-ever FinTech Conference on October 23rd and 24th, 2023. Named "Fintech for Inclusivity, Growth, and the Future," details of which can be found at https://www.wpi.edu/ffea, the conference aimed to establish WPI as a leading center for FinTech discussion, research, and excellence.

The event was a significant success, attracting around 275 participants, including 50 industry leaders and 24 FinTech scholars from across the globe. Over the course of two days, the conference featured lively debates and insightful research presentations. These discussions highlighted the revolutionary impact of FinTech on the traditional financial sector and its crucial role in generating employment opportunities.

Research presentations from this conference are in the process of being compiled for a "Special Issue" in the Financial Research Letters Journal. This journal boasts an Impact Factor of 10.4 and is recognized as a top-tier A-Journal. The call for papers can be found here: https://www.sciencedirect.com/journal/finance-research-letters/about/call-for-papers#fintech-for-inclusivity-growth-and-the-future.

To date, the Lab has supported numerous scholarly activities, including student and faculty research publications, conferences, and active working papers, such as:

Scholarly Publication of works supported by the FinTech Lab

- Jackson, D., Dunbar, K., Sarkis, J., and Sarnie, R., (2023). Advancing Fintech through a transdisciplinary approach. I-Science. Vol. 26, Issue 9, 107694, https://doi.org/10.1016/j.isci.2023.107694.

- Dunbar, K., Treku, D., Sarnie, R., and Hoover, J., (2023). What does ESG risk premia tell us about mutual fund sustainability levels: A difference-in-differences analysis. Finance Research Letters, Volume 57, 104262, https://doi.org/10.1016/j.frl.2023.104262.

- Dunbar, K., Sarkis, J., and Treku, D., (2024). FinTech for environmental sustainability: Promises and pitfalls, One Earth, Volume 7, Issue 1, 2024, Pages 23-30, ISSN 2590-3322, https://doi.org/10.1016/j.oneear.2023.12.012.

- Dunbar, K., Treku, D., (2024). “Examining the impact of a Central Bank Digital Currency on the access to banking.” At International Review of Financial Analysis

Research Studies currently Under Review for Publication

- “Unveiling the Nexus: Carbon finance and climate technology advancements.”

- “The decentralization enigma in DeFi: Impact of U.S. policy rate changes.”

- “Does energy transition investment flows aid climate commitments?”

- “Influence of Artificial Intelligence on the Disposition Effect and Trading Behaviors in Futures Markets.”

- “Impact of Climate Action Commitments on Carbon Mitigation Technologies”

-

“Investors behavioral response to Corporate Carbon Offsets.”

Conference Presentations of Research supported by FinTech Lab

- June 2024. “Unveiling the Nexus: Carbon finance and climate technology advancements", CINSC 2024 ICMA Reading.” Reading, UK

- June 2024. “Unraveling the enigma of decentralization in DeFi: Impact of U.S. policy rate changes,” Presented at the 2024 FMA European Conference, Turin, Italy.

- February 2024. “The decentralization enigma in DeFi: Impact of U.S. policy rate changes.” Presented at the 2024 Academy of Economics and Finance conference, Conference, Charleston, SC

- December 2023. “Unraveling the enigma of decentralization in DeFi: Impact of U.S. policy rate changes,” Presented at the Annual Conference of the British Accounting Review. Cape Town, South Africa

-

December 2023. “The decentralization enigma in DeFi: Impact of U.S. policy rate changes” Presented at the Annual Conference of the British Accounting Review. Cambridge, MA

Collaborations with FLAME University

Although FLAME University was not able to attend the 2023 Fintech for Inclusivity, Growth, and the Future conference, we are eager to collaborate on the 2026 conference.

In February 2024, Professor Kwamie Dunbar, PhD, Director of the FLAME-WPI FinTech Lab, served as the guest speaker at a special session titled "FinTech: Present and Future," hosted by FLAME University for its faculty and students. This presentation extended the discussions from the “Fintech for Inclusivity, Growth, and the Future” conference, focusing on the future direction of FinTech and emphasizing the importance of collaborative research between our institutions.

Student Research – AY 23/24

Undergraduate and graduate research in FinTech is critical to applied learning and a hallmark of WPI’s project-based learning approach. Consequently, student research projects are of high priority given FinTech’s rapidly evolving nature and its significant impact on global financial systems. These projects offer students a hands-on experience, enabling them to tackle real-world challenges and contribute innovative solutions to the sector. Through such engagement, WPI fosters a deep understanding of FinTech among its students, preparing them to become leaders and innovators in this dynamic field.

FinTech Lab support of student-led independent research projects and Major Qualifying Projects:

- “Impact of Climate Action Commitments on Carbon Mitigation Technologies”

- “What does ESG risk premia tell us about mutual fund sustainability levels: A difference-in-differences analysis”

- “The ICT Forex Trading Strategy and Algorithmic”

- “Influence of Artificial Intelligence on the Disposition Effect and Trading Behaviors in Futures Markets.”

- “ESG Factors and Wealth Management” with Green Future Wealth Management

Further the FLAME-WPI FinTech Lab will continue to support student research in WPI’s BS, MS and PhD programs which will be an integral part of the FLAME-WPI FinTech lab. Students will have access to Lab supported software such as Wharton Research Data Services (WRDS), Morningstar and Capital IQ.

Introducing WPI's New MS in FinTech

How will you shape the future of finance? Utilize unstructured data, predictive analytics, and artificial intelligence (A.I.) insights to drive new financial thinking and processes that deliver innovative financial products and strategies for long-term productivity improvements and economic growth. With these skills, you’ll be invaluable to established firms and startups as we move rapidly to a digitized and data-intensive world. This program expands WPI's FinTech offerings; a graduate certificate is still available.

Introducing WPI's New BS in FinTech

We’re quickly moving toward a more digitized and data-intensive world. Equipped with a Bachelor of Science in Financial Technology (FinTech) from WPI, you'll be well prepared to help shape the future of finance. While working toward your degree, you’ll be introduced to key financial technologies and their applications in financial services, all while developing a broad, solid understanding of FinTech innovations, as well as their benefits and limitations. Through WPI’s signature project-based education, you’ll learn the skills needed to meet the critical needs and growing demands for quantitative modeling, analysis in finance, and other aspects in the FinTech industry.